| Индикатор пирсон для МТ5 |

[*]

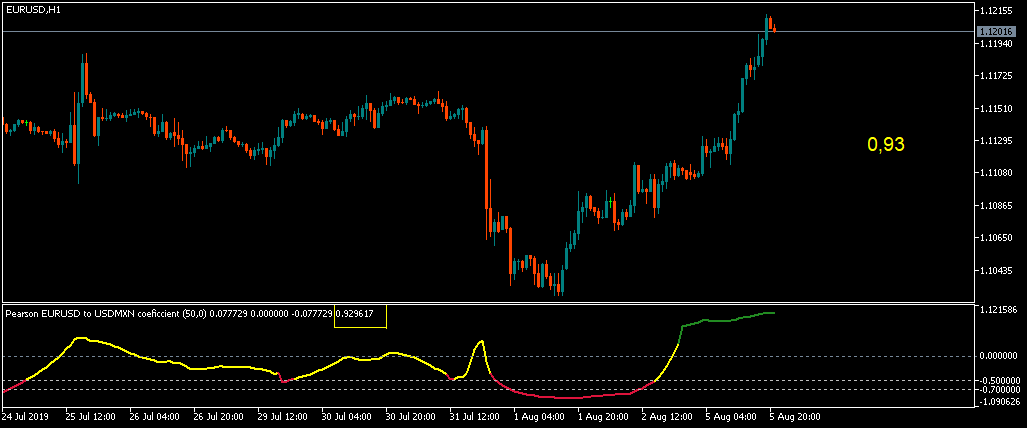

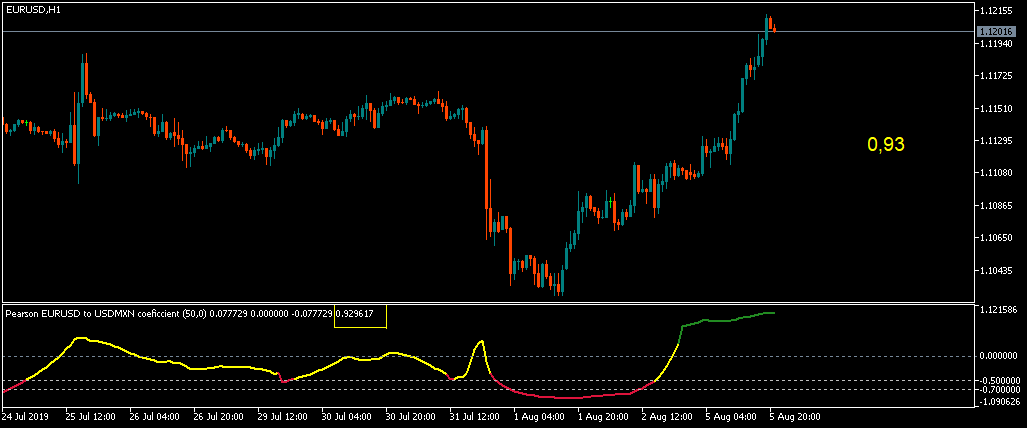

Прошу переделать индикатор пирсон.

Кидая на график индикатор, не должен выводиться график индикатора, а должна появляться цифра как в примере, округленная до десятых.

Соответственно размер цвет и расположение цифры можно менять в настройках.

файл не загружается, привожу код:

Кидая на график индикатор, не должен выводиться график индикатора, а должна появляться цифра как в примере, округленная до десятых.

Соответственно размер цвет и расположение цифры можно менять в настройках.

файл не загружается, привожу код:

//------------------------------------------------------------------

#property copyright "© mladen, 2018"

#property link "mladenfx@gmail.com"

#property description "Pearson coeficcient"

//------------------------------------------------------------------

#property indicator_separate_window

#property indicator_buffers 7

#property indicator_plots 4

#property indicator_label4 "Pearson coeficcient"

#property indicator_type4 DRAW_COLOR_LINE

#property indicator_color4 clrYellow,clrCrimson,clrForestGreen

#property indicator_width4 2

//#property indicator_label1 "Level up"

//#property indicator_type1 DRAW_LINE

//#property indicator_color1 clrForestGreen

//#property indicator_style1 STYLE_DOT

#property indicator_label2 "Middle level"

#property indicator_type2 DRAW_LINE

#property indicator_color2 clrDarkGray

#property indicator_style2 STYLE_DOT

//#property indicator_label3 "Level down"

//#property indicator_type3 DRAW_LINE

//#property indicator_color3 clrCrimson

//#property indicator_style3 STYLE_DOT

#property indicator_level1 -0.5

#property indicator_level2 -0.7

//--- input parameters

enum enColorMode

{

col_onZero, // Change color on middle line cross

col_onOuter // Change color on outer levels cross

};

input string inpSymbol = "USDMXN"; // Second symbol

input int inpPeriod = 50; // Period

input int inpLag = 0; // Lag of the second symbol

input ENUM_APPLIED_PRICE inpPrice = PRICE_CLOSE; // Price

input enColorMode inpColorMode = col_onOuter; // Change color mode

//--- indicator buffers

double val[],valc[],flup[],flmi[],fldn[],diff[],difl[];

string _forSymbol;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int OnInit()

{

//--- indicator buffers mapping

SetIndexBuffer(0,flup,INDICATOR_DATA);

SetIndexBuffer(1,flmi,INDICATOR_DATA);

SetIndexBuffer(2,fldn,INDICATOR_DATA);

SetIndexBuffer(3,val,INDICATOR_DATA);

SetIndexBuffer(4,valc,INDICATOR_COLOR_INDEX);

SetIndexBuffer(5,diff,INDICATOR_CALCULATIONS);

SetIndexBuffer(6,difl,INDICATOR_CALCULATIONS);

//--- indicator short name assignment

_forSymbol = (inpSymbol=="") ? _Symbol : inpSymbol;

IndicatorSetString(INDICATOR_SHORTNAME,"Pearson "+_Symbol+" to "+_forSymbol+" coeficcient ("+(string)inpPeriod+","+(string)inpLag+")");

//---

return (INIT_SUCCEEDED);

}

//+------------------------------------------------------------------+

//| Custom indicator de-initialization function |

//+------------------------------------------------------------------+

void OnDeinit(const int reason)

{

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int OnCalculate(const int rates_total,const int prev_calculated,const datetime &time[],

const double &open[],

const double &high[],

const double &low[],

const double &close[],

const long &tick_volume[],

const long &volume[],

const int &spread[])

{

if(Bars(_Symbol,_Period)<rates_total) return(prev_calculated);

//

//---

//

double pers = MathSqrt(inpPeriod);

MqlRates _ratesf[1];

MqlRates _ratesl[1];

for(int i=(int)MathMax(prev_calculated-1,0); i<rates_total && !_StopFlag; i++)

{

int _ratesfCopied = CopyRates(_Symbol ,0,time[i ],1,_ratesf);

int _rateslCopied = (i>=inpLag) ? CopyRates(_forSymbol,0,time[i-inpLag],1,_ratesl) : CopyRates(_forSymbol,0,time[i],1,_ratesl);

diff[i] = (_ratesfCopied == 1) ? getPrice(inpPrice,_ratesf) : 0;

difl[i] = (_rateslCopied == 1) ? getPrice(inpPrice,_ratesl) : 0;

double dev1 = iDeviation(diff,inpPeriod,i);

double dev2 = iDeviation(difl,inpPeriod,i);

val[i] = (dev1!=0 && dev2!=0) ? iCovariance(diff,difl,inpPeriod,i)/(dev1*dev2) : 0;

double pe = 0.6745*(1.0-val[i]*val[i])/pers;

flup[i] = 6.0*pe;

fldn[i] = -6.0*pe;

flmi[i] = 0;

switch (inpColorMode)

{

case col_onOuter : valc[i] = (val[i]>flup[i]) ? 2 : (val[i]<fldn[i]) ? 1 : 0; break;

case col_onZero : valc[i] = (val[i]>flmi[i]) ? 2 : (val[i]<flmi[i]) ? 1 : (i>0) ? valc[i-1]: 0; break;

}

}

return(rates_total);

}

//+------------------------------------------------------------------+

//| Custom functions |

//+------------------------------------------------------------------+

double iDeviation(double& array[], int size, int i, bool isSample = false)

{

double avg = array[i]; for (int k=1; k<size && (i-k)>=0; k++) avg += array[i-k]; avg /= (double)size;

double sum = 0;

for (int k=0; k<size&& (i-k)>=0; k++) sum += (array[i-k]-avg)*(array[i-k]-avg);

if (isSample)

return(MathSqrt(sum/(double)(size-1)));

else return(MathSqrt(sum/(double)(size)));

}

//

//---

//

double iCovariance(double& indep[], double& depen[], int size, int i, bool isSample = false)

{

double avgi = indep[i]; for (int k=1; k<size && (i-k)>=0; k++) avgi += indep[i-k]; avgi /= size;

double avgd = depen[i]; for (int k=1; k<size && (i-k)>=0; k++) avgd += depen[i-k]; avgd /= size;

double sum = 0;

for (int k=0; k<size && (i-k)>=0; k++) sum += (indep[i-k]-avgi)*(depen[i-k]-avgd);

if (isSample)

return(sum/(size-1));

else return(sum/(size));

}

//

//---

//

double getPrice(ENUM_APPLIED_PRICE tprice, MqlRates& _rates[])

{

switch(tprice)

{

case PRICE_CLOSE: return(_rates[0].close);

case PRICE_OPEN: return(_rates[0].open);

case PRICE_HIGH: return(_rates[0].high);

case PRICE_LOW: return(_rates[0].low);

case PRICE_MEDIAN: return((_rates[0].high+_rates[0].low)/2.0);

case PRICE_TYPICAL: return((_rates[0].high+_rates[0].low+_rates[0].close)/3.0);

case PRICE_WEIGHTED: return((_rates[0].high+_rates[0].low+_rates[0].close+_rates[0].close)/4.0);

}

return(0);

}

//+------------------------------------------------------------------+

Понравилcя материал? Не забудьте поставить плюс и поделиться в социальной сети!

05 августа 2019

|

06 августа 2019

|

Комментарии (4)

1 VDev Сообщений: 4 - Алексей

35 AM2 Сообщений: 16665 - Андрей

35 AM2 Сообщений: 16665 - Андрей

5 max9000 Автор Сообщений: 29 - Max

Зарегистрируйтесь или авторизуйтесь, чтобы оставить комментарий